APPELLANT DIVISION OF THE STATE OF CALIFORNIA

SUPERIOR COURT OF THE COUNTY OF SAN MATEO

MICHAEL P. MELLEMA | Court of Appeal No. 18- AD-000034

Plaintiff / Appellant |

|

VS | Trial Court Case 16CLJ01063

|

MICHELE D. FRIEDMAN |

TODD M. FRIEDMAN |

Defendant / Respondents |

________________________|

Appeal From Amended Judgment After Trial

Of The Superior Court, County of San Mateo

Hon. V. Raymond Swope

APPELLANT’S OPENING BRIEF

Michael P. Mellema, in pro per

708 Plymouth Way

Burlingame, CA 94010

650-343-3307

[email protected]

Appellant

Self-Represented

TABLE OF CONTENTS

TABLE OF AUTHORITIES 3

STATEMENT OF THE CASE 3

STATEMENT OF APPEALABILITY 4

STATEMENT OF FACTS 4

ARGUMENT

I DEFENSE ATTORNEY MISCONDUCT 8

Refusal to Resolve Discovery Issues 8

False and Misleading Trial Brief Statements 9

II SUBORNING PERJURY 13

Michele Friedman Testimony 13

Todd Friedman Testimony 17

III CONCLUSION 19

IV RELEVANT STATUTES 20

CERTIFICATE OF COMPLIANCE 23

APPENDIX 24

TABLE OF AUTHORITIES

Insurance Code, 1871.7, Insurance Fraud Prevention Act

STATEMENT OF THE CASE

The original complaint was filed as a false claim for insurance under the Insurance Code’s Insurance Fraud Prevention Act, I.C. 1871. The complaint cited that the alleged damage was pre-existing and Defendants collected from Plaintiff’s insurer, Farmer’s Insurance Exchange

This Appeal seeks to vacate the Amended Judgment After Trial, filed August 15, 2018 that superceded the Judgment After Trial, filed, June 26, 2018. At trial, Defense Counsel’s request for reimbursement of all fees and expenses was denied.

June 22 Transcript, Page 86, line 18 “The request for attorney’s fees under California Insurance Code Section 1871.7 (g) (5) is denied”

Counsel’s Amended Judgment reverses that denial and is a continuation of his attack on a plaintiff by demanding additional fees for Defendant which were covered by their insurer. Defense attorney has falsely claimed the $1,053 were the direct costs of the Defendant. They are, in fact, the filing and travel fees incurred by Council, not Defendant and included in the total legal fees denied in the original judgment. The Amended Judgment was filed more than thirty days after the initial ruling was filed.

This Appeal also seeks to consider several issues:

Defense Attorney’s misconduct including failure to comply with discovery, false and misleading statements in the Trial Brief, suborning perjury, and Defendant’s actual perjury. Relevant statutes shown within the text in [ xxx] are cited at the end of this Brief.

STATEMENT OF APPEALABILITY

This appeal is from the judgment of the San Mateo County Superior Court and is authorized by the Code of Civil Procedure, section 904.2, subsection (a)

STATEMENT OF FACTS

On May 31, 2015, two cars were both backing up at the same time and made contact in the middle of the street. Typically, when two cars are both backing up and make contact, insurance companies only cover their own policyholder. After only a few minutes, Defendant, Michele Friedman, left the scene quickly, providing only her first name [CVC 20002] and never returned. Five days later, her husband left a message on Plaintiff’s phone falsely claimed there was a dented fender and suggested a cash settlement. Five days later, USAA Casualty Insurance sent a hostile and threatening demand letter to Plaintiff. They also told Ms. Friedman to file a SR-1 accident report with the Department of Motor Vehicles (DMV) without evidence that damage exceeded $750. On June 15, they obtained an estimate from Chilton’s Body Shop for $963.17 and forwarded it to USAA and Farmer’s Insurance. The estimate identified transferred paint on a lower tail light.

On June 19, USAA wrote a check to Michele Friedman for $963.17. However, on the 23rd, they took their car to Multi Craft Body Shop who wrote an invoice for $1,366.17 upon delivery. Multi craft never did their own estimate [CCR 2695.85]. Chilton’s estimate was sent to a Brian Downey, an Arizona adjuster, who fabricated an additional $403 of undocumented cost increases and dated it June 24, 2015. On June 25, Todd Friedman paid Multi Craft $963.17.

Since no one disclosed the SR-1 filing to Plaintiff, the DMV threatened to suspend Plaintiff’s license for one year. A resulting chargeable accident led to a 68% increase in insurance premiums. Plaintiff filed a civil suit under seal in August 2016 for insurance fraud under the Insurance Code, Section 1871.7, “Insurance Fraud Prevention Act” In May 2017, Presiding Judge Susan Etezadi removed the seal and ordered all parties to be served.

On August 22, 2017, Law and Motion Judge Richard DuBois granted Defendant’s demurrer and added that Plaintiff has shown sufficient facts for a cause of action for insurance fraud against the Defendants.

AT TRIAL

June 11 transcript, Page 3, line 15 Defense Attorney, Ryan Greenspan claimed that “Todd Friedman is no longer a party to this case.” Plaintiff, Michael P. Mellema, never intended nor agreed to exclude Todd Friedman from this case as his phone calls on June 5 and 6 were instrumental to initiating this case and his signing a sworn affidavit claiming Mellema caused $1,366.17 of damages although he was not present caused Plaintiff to be threatened with a license suspension.

The trial began in the late afternoon on June 11, 2018, in the court of Judge V. Raymond Swope.

The Judge dispensed with any opening statements. Plaintiff’s questioning was constantly interrupted with Defense objections. Both Defendants should have been treated as hostile witnesses. Testimony was interrupted and continued to the 22nd.

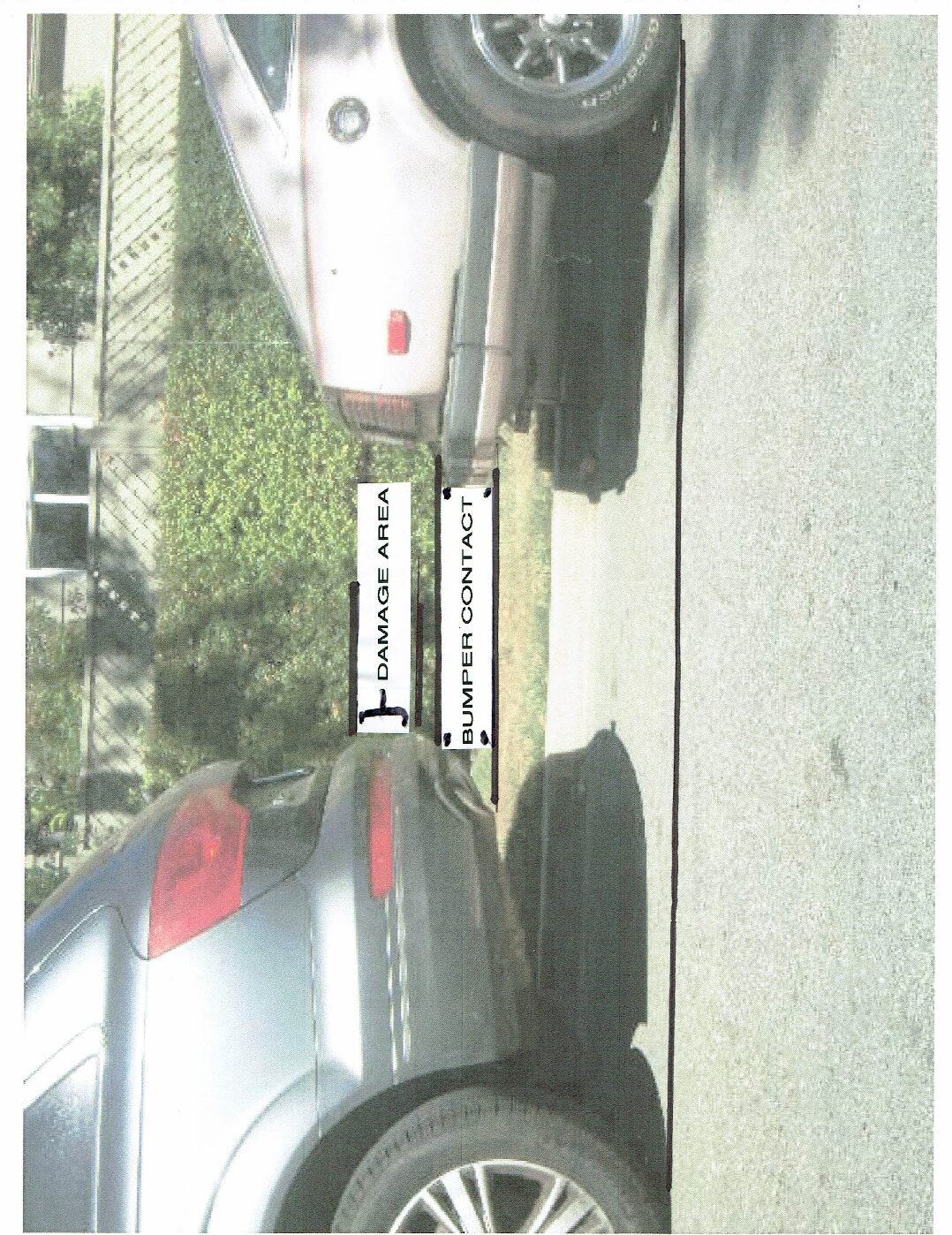

Evidence to support a civil cause of action for insurance fraud was addressed in the testimony of Michele Friedman with two issues. First, Defendant’s own damage claim photos (Exhibit 1) showed white paint transferred onto an unbroken lower red tail light on a 2014 Audi Q5. The color was verified in a deposition from Chilton’s Auto Body Shop. A photo of Plaintiff’s rear bumper (Exhibit 4) shows a hard black rubber cover that is five inches lower than Defendant’s tail light. Second, it was pointed out that Defendant had completely passed Plaintiff’s property before turning left into a neighbor’s driveway across the street. If she was turning around as she claimed, she would have gone in the opposite direction and avoided any contact (Exhibit 5) . Her bumper could only make contact if she went in the wrong direction, thereby causing the accident.

When Judge Swope issued his ruling, he didn’t give his rational for siding with the defendants’ unsupported claims over the Plaintiff’s hard evidence. He simply stated there was insufficient evidence.

Defendants’ attorney, Ryan Greenspan, requested that Plaintiff should reimburse the Defendant’s legal fees according to C.I.C. 1871.7(g)(5) for nearly thirty thousand dollars. These fees had been paid by USAA Casualty Insurance.

C.I.C. 1871 (g)(5) If the district attorney or commissioner does not proceed with the action, and the person bringing the action conducts the action, the court may award to the defendant its reasonable attorney’s fees and expenses if the defendant prevails in the action and the court finds that the claim of the person bringing the action was clearly frivolous, clearly vexatious, or brought primarily for purposes of harassment.

The Judge said that Plaintiff believed the charges were true and the complaint was not filed for harassment, then denied Greenspan’s request and ordered him to prepare the order. Greenspan’s proposed order only cited the vague application of C.P, 631.8. This code makes no mention of monetary issues and Greenspan conveniently omitted the request and denial of any compensation.

The decision, based on Defendant’s perjured testimony was not initially appealed on the expectation that all fees and expenses were denied. Although Plaintiff disagreed with the decision, he accepted it only because the DMV has cleared the false chargeable accident and Hartford Insurance has rebated the excessive premiums based on the evidence submitted to them.

In spite of the denied reimbursement, Greenspan filed an amended judgment requiring Plaintiff to pay Defendant $1,053 for Court expenses. Actually, the expenses were Council’s travel and filing fees included in the denied request. He did not cite any codes or precedence that justified an amendment that reversed the original ruling. When Plaintiff received a copy of his amendment, he believed Judge Swope would maintain his denial. The amount would be three times the amount of the insurance premium penalty and over 50% of the monthly income and is clearly punitive in nature. It would be merely pocket change to Defendants but a serious financial hardship to Plaintiff.

The husband can call to scam a cash settlement and the wife can drive by to get the make, model and license, but fail to inform Plaintiff of the SR-1 filing, the $963 estimate or switching to a more expensive repair shop, thereby setting up the Plaintiff for a license suspension, chargeable accident and a huge increase in insurance premiums.

Something is wrong when two defendants with a six figure income, aided by their attorney, continue to attack and harass a senior insurance fraud victim on a fixed income.

ARGUMENTS

I. DEFENSE ATTORNEY MISCONDUCT

Refusal to Resolve Discovery Issues

When Plaintiff noticed the unusual change from one repair shop to another, he repeatedly asked for an explanation. In spite of CRC 3.724, Meet & Confer to Resolve Issues of Discovery. Greenspan refused. In February 2018 Plaintiff sent Greenspan written depositions from both body shops along with Judicial Council form DISC-015, Request for Witness Statements and Evidence. Again, Greenspan refused to respond.

In a letter dated May 10, 2018, he stated that the request was made too early and therefore it had no legal significance. Greenspan had no obligation to disclose anything. The result was that Plaintiff was left in the dark until the Court Clerk gave Greenspan’s Trial Brief, List of Witnesses and Exhibits to Plaintiff just five minutes before trial. This guaranteed an unethical ambush situation where Plaintiff would have no time to prepare a reasonable response. That Brief contained many false and discredited statements that were intended to mislead the Court. Greenspan was not confused or ignorant of the facts but acted maliciously and with corrupt intent.

As an in pro per litigant, Mellema was unaware of the requirements of Appendix 2, Long Cause Trial Rules Checklist that said parties were to meet and confer and exchange Trial Briefs seven days or more before Trial. However, with his obsession for civil procedures, Greenspan had no such excuse. The brief review left Plaintiff in shock over the many false and misleading statements. Plaintiff filed his own Trial Brief on June 19, prior to the June 22, 2018 continuation

False and Misleading Trial Brief Statements

Greenspan’s “Factual Summary” is factual fantasy. If the Court relied on Greenspan’s Trial Brief, it was deliberately misled as he has taken great liberties with the truth. Of all of Defendant’s claims there is no actual evidence to support any of them. While the Trial Brief appears to be authored by Greenspan, it was signed by Dewey Wheeler, partner at McNamara, Ney, Beatty, Slattery, Borges & Ambacher, LLP.

In the opening paragraph, it is falsely implied that both driveways are directly opposite of each other. Actually, 711 Plymouth Way is the fourth house on the south side and 708 is the third house on the north side. Defendant’s statement to Farmers Insurance was that she passed the street she wanted, turned left on to Plymouth “out of habit” and turned left into the driveway at 711 to turn around. If she were turning around, she could not see Plaintiff’s car in her rearview camera or have the rear bumper exposed.

The false claims in the Brief follow:

Page 1, line 25. Greenspan falsely claims that Defendant took defensive driving actions to avoid contact. This is completely contradicted by the notarized statement of a witness who also gave statements to USAA and Farmers. Greenspan never attempted to interview the witness to verify her account. Under oath, Ms. Friedman stated it only took two seconds for her to reverse course. That would require placing the car in reverse, moving backwards, looking in her rearview camera, seeing an object, realizing it’s approaching, stepping on the brake, shifting gears, stepping on the gas and moving forward. All of this can not be done in two seconds as she claimed and ignores that she was backing in the wrong direction.

Page 2, line 1. “There was a small dent in Ms. Friedman’s fender”. Fact: Defendant’s own damage claim photos show white paint applied to an unbroken lower red tail light. No dent is visible in photos. Some of the white markings appear to be reflections.

Page 2, line 11. Greenspan falsely claims Defendants switched to their “regular mechanic, Multi Craft Auto Body”. Fact: USAA told Multi craft to prepare an invoice for $1,366.17 on June 23 when the vehicle was delivered. Multi Craft never prepared a required estimate of their own. [CCR 2695.85] USAA sent Chilton’s estimate to Brian Downey, an Arizona adjuster, to fabricate undocumented additional expenses [P.C. 182]. No other local repair shops or adjusters were asked to provide a quote. This was done to circumvent California’s Adjuster Act [I.C.14000 – 14099]. Defendants were told by USAA to switch to Multi Craft for their repairs [I.C. 758.5a]. To establish that Multi Craft was not their “regular mechanic”, Plaintiff served Multi craft with a subpoena for all invoices and work orders for any Friedman vehicle prior to July 2015. Greenspan, fearing exposure, managed to suppress Plaintiff’s access to this subpoena. The Appeals Court will find that this evidence confirms that the Defendants did not have any history of prior business with this “mechanic”.

Page 2, line 13. Greenspan falsely claims “Defendant paid $963.17 directly to Multi Craft $963.17 out of their own pockets and then filed a claim through USAA for reimbursement”. [P.C 118] Fact: Several prior court filings contained evidence that contradicted this claim. USAA sent Plaintiff a demand letter on June 10th. Defendant submitted Chilton’s estimate for $963.17 and USAA wrote a check on June 19 for that amount. Todd Friedman paid Multi Craft on June 25th. If it was out of their own pocket they had no requirement other than to pay their $500 deductible and submit the balance to USAA.

Page 2, line 18. USAA claimed “their investigation revealed Plaintiff was responsible”. Fact: USAA did not conduct any investigation. At Trial, Michele Friedman said “I would assume it was the phone conversation I had with my insurance company”. They never spoke to Plaintiff or a witness before sending a very hostile and threatening demand letter for unspecified damages. It was after USAA received a response that said they were misled by the Friedmans that they switched to the more expensive repair shop in retribution.

Page 3, line 5. “Plaintiff alleged that Defendant and USAA conspired together to have USAA make payments to both Chilton’s and Multi Craft for the same repair work”. Fact: Totally false. Plaintiff knew that Chilton’s only provided an estimate and did not perform any work. This is a false accusation.

Page 3, line 23. The District Attorney “declined to participate in the action”. Fact: After more than 60 days allowed for an investigation, Plaintiff found that no one had accessed the subpoenas held by the Court Clerk’s Office. When asked about the status of the investigation, the District Attorney issued his “Notice to Decline to Intervene”. No investigation had been conducted.

Page 4, line 14. Greenspan repeatedly complained that the Complaint continued to include a “cause of action against each Defendant for perjury”. Fact: This is and has always been a civil suit for civil damages. The Insurance Fraud Prevention Act states that any person can file a complaint that includes all material evidence and information that the Plaintiff possesses. The evidence that showed a willful intent were two statements filed by the Friedmans with the DMV under penalty of Perjury. If the Court found in favor of the Plaintiff’s claim of Insurance Fraud, then the two statements were automatically perjured. While California does not allow private prosecutions, it does allow the admission of evidence to a felony in a civil case, and that evidence can be referred to the District Attorney to file charges. [P.C.872]

Page 6, line 17. “Plaintiff’s entire case is utterly frivolous and baseless”. Fact: On August 22, 2017, Law and Motion Judge Richard DuBois granted defendant’s demurrer and added that “Plaintiff has shown sufficient facts for a cause of action for insurance fraud against the defendants”. After all the false defense statements, Defense has failed to explain how the transferred white paint on the unbroken taillight could come from Plaintiff’s hard black rubber bumper. Plaintiff’s car does not have any white paint anywhere.

Page 6, line 25. “Ms. Friedman conspired with USAA to “double dip” and have the cost of repair work to Defendant’s vehicle paid twice, once to Chilton and once to Multi Craft”. Fact: This is a complete fabrication by Greenspan. Plaintiff always knew that Chilton’s only provided an estimate.

Page 7, line 4. “The Friedmans elected to have their vehicle repaired at Multi Craft, who was their regular mechanic, and have USAA agreed to pay these costs. Multi Craft found additional work that needed to be performed on Defendants’ vehicle”. Fact: Multi Craft was told by USAA to issue an invoice at the time the Friedmans delivered their car. They never prepared their own estimate.[C.C.R. 2695.85] The added cost was fabricated by an Arizona adjuster to Chiltons estimate and he never inspected the car. Part of the added “work” was to change the labor rate from $76/hr to $90/hr, delete the “Polish Paint Transfer” and replace it with “Polish exhaust pipe”. Repair to a lower spoiler was added although Chiltons stated it was not damaged. [P.C. 182]

Page 8, line 10. “Allegation would have to be supported by expert testimony”. Fact: All that is required is anyone that is not color blind. Can they tell the difference between transferred white paint and a black bumper?

Page 8, line 18. “Defendant is entitled to recover reasonable attorney fees and expenses if the person bringing the action conducts the action, the court may award to the defendant its reasonable attorney’s fees and expenses if the defendant prevails in the action and the court finds the claim of the person bringing the action was clearly frivolous, clearly vexatious, or brought primarily for the purposes of harassment”. All of the above false statements were intended to encourage the Court to further penalize the Plaintiff for filing a legitimate insurance fraud complaint. The Court found that the action was not frivolous, vexatious, or for harassment.

Greenspan continues to make accusations that the Complaint was frivolous and baseless but still can not explain the white paint and ignores Judge DuBois’s August 22, 2917 ruling.

Greenspan made the above false statements in order to undermine and discredit Plaintiff’s legitimate insurance fraud charges and prejudice the Court. He did not provide any hard evidence to support any of his allegations or Defendant’s testimony and resorted to unethical ambush tactics. If the Court relied on any of his Trial Brief, it was seriously misled.

II. SUBORNING PERJURY

Greenspan knowingly and with corrupt intent facilitated and encouraged his clients to make several false statements while under oath.

Michele Friedman’s Testimony

June 11 Transcript, Page 23, line15, 23 “The photos are not very clear . . .I can’t tell really if it’s the reflection of the sun or the dent”. The photos she was viewing are color enlargements of their only damage claim evidence. There is no evidence of damage to a lower spoiler. There are two near identical white marks, one on the lens, that don’t show on the side view. The plastic lens and the steel plate bumper are flush and neither extends out over the other. If the plastic lens is not cracked or scratched, then the bumper can not be dented. Neither photo clearly shows any dent.

June 11 Transcript, Page 44, line 7 “I do see a difference in height”. Ms. Friedman was shown a photograph of the Datsun backed up to an Audi Q5 and the difference in height was obvious that the Datsun bumper was 5” lower that the tail light. Since this had been mentioned multiple times in the pass, she and Council had to fabricate a scenario to explain how the alleged damage could occur.

June 11 Transcript, Page 45, line 11 “It looks like a conversation between me and your insurance company “. Ms. Friedman gave a statement to Farmer’s Insurance on June 22nd. She failed to mention that she had filed an SR-1 accident report or was planning to switch repair shops the next day. As late as July 7th, Farmer’s believed the possible liability was still only $963 and told Mellema that as long as it was under $1,000, they would not raise rates.

June 11 Transcript, Page 48, line 15 Witness: “Your driveway is pretty much right across the street from the driveway I pulled into” Directly across the Street? “ Yes”

Ms Friedman refused to acknowledge that she had to completely pass Plaintiff’s property before she turned left into the neighbor’s driveway across the street

Fact: Defendant needed the Court to believe this false claim in order to believe her defensive driving actions. 711 Plymouth Way is the forth house from the corner on the south side and 708 Plymouth is the third house from the corner on the north side.. The two houses have double wide driveways that only overlap by about one foot. As both cars were in the right hand lane of each driveway, the Friedman’s car was fifteen to twenty five feet beyond Plaintiff’s car.

June 11 Transcript, Page 49, line 6 How much time did you take for your defensive driving? “Two to three seconds for the whole process.”.Ms. Friedman falsely claimed she took defensive driving actions in only two seconds and offered no evidence to substantiate that claim. She ignores that she was backing in the wrong direction and she was the cause of the accident. Her story was completely contradicted by a witness that provided a notarized statement, and provided statements to both insurance companies. Greenspan never bothered to interview the witness. If she was turning around as she claimed, she would have gone in the opposite direction and avoided any contact. This was demonstrated by Plaintiff’s graphics in Exhibit 5

June 22 Transcript, Page 28, line 15 “I was completely in the driveway”. “on a higher elevation than the rear of the vehicle at the time of the impact”. [P.C. 118] This is another completely false claim. After prior testimony showed there was a five inch difference between Plaintiff’s Bumper and her tail light, she had to fabricate some story to explain how it could happen. This subject was not addressed in the Trial brief and was another ambush tactic.

The driveway at 711 Plymouth is short and the owners park right up to the sidewalk. Ms. Friedman told Farmer’s she had to swerve to miss the parked car so she was not in the driveway. Plymouth Way is 25 feet wide and neighbors park on the street. Since getting a license in 1962, Mellema has never backed out so far as to pose a threat to cars parked on the street.

June 22 Transcript, Page 33, line 8 “Immediately after the incident, did you and Mr. Mellema have any conversation? “Yes, I told him there are scratches and a dent.” Fact: She barely stayed as much as five minutes before saying she had to leave, giving only her first name and never returning. Mellema did not have an opportunity to closely inspect the alleged damage but did note that it was white marks on the tail light.

June 22 Transcript, Page 35, line 5 “What was the reason you decided to bring the Audi to Multi Craft instead of having Chilton do the repairs? “ They had done prior work on my other vehicle and I was impressed with their service”.. Ms. Friedman falsely claimed they switched from Chilton’s Body Shop to their “favorite mechanic” at Multi Craft. This was another ambush planned by Greenspan as he was asked several times to explain the change. Defense offered no evidence that they had ever been to Multi Craft in the past. In fact, they were told by USAA to go there in violation of C.I.C. 758.5a

June 22 Transcript, Page 37, line 19 “What was the purpose of the DMV hearing? “To discuss the repair amount to the car”. This is another false claim. The purpose was to discuss the license suspension because of a delayed SR-1 filing. Since the Friedmans and both insurance companies failed to disclose that she had filed an SR-1, Mellema was threatened with a one year suspension. Prior to the hearing Mellema obtained a public record request from the DMV that included the SR-1, and Multi Crafts invoice. Mellema was shocked to find it was for $1,366.17 and immediately met with Multi Craft. They said USAA told them to create the invoice because Chilton’s had missed some repairs. Chilton’s said they did not miss anything and that their files showed it was white paint on the tail light. Mellema obtained two photographs from Farmer’s that were Defendant’s sole evidence of damages. This was determined by Plaintiff to be insurance fraud and Mellema intended to discuss it at the hearing. Instead, the hearing officer said there were only three things to be discussed and there would be no exception. The Friedman’s gleefully flashed their Iphone pictures of the damage not knowing Mellema already had copies.. The subsequent suspension was overturned by the DMV Director’s Office.

Todd Friedman’s Testimony

Todd Friedman was asked to read the transcribed voice mail that he left on Plaintiff’s phone on June 5, 2015.

June 22 Transcript, Page 44, line 11, “I got an estimate at that point”. Who was the estimate from? “The first estimate was from Chilton Auto Body” He could have said he was bluffing but under oath he said he had the Chilton’s estimate which was not created until June 15th. This was clearly perjury. Ms. Friedman said they only had two estimates, Chilton’s dated June 15 and Multi Craft dated June 24.

What Ms. Friedman referred to as Multi Craft’s estimate was actually Chilton’s estimate modified by Brian Downey, an Arizona adjuster in order to circumvent California’s Adjuster Act. Multi Craft never prepared their own estimate as required by law.

Todd Friedman was asked about an affidavit he signed stating to the DMV that Plaintiff was the other party responsible for $1,366.17 in damages to their car. The document states “The other party (Michael Mellema) involved in this accident is disputing it’s reportability

June 22 Transcript, Page 46, line 26 Do you know where you were at that particular time? (time of the accident) “I don’t recall” But you were not at the scene? “No, I was not ”, Mr. Friedman was not the driver, passenger or witness to the accident and had no standing to sign a sworn affidavit claiming Plaintiff was responsible for the damage. Mr. Friedman claims he was only validating the amount but it was implied that the other party was responsible. The affidavit was the basis for the DMV trying to suspend Plaintiff’s license. Plaintiff had not seen the car since May 31st and was not notified by any one of the SR-1 filing. That statement was signed under penalty of perjury. The basis for this suit is that the damage was pre-existing and not caused by the Plaintiff

Under cross-examination by Greenspan, Mr. Friedman claimed he was the one to contact USAA although in previous testimony Ms. Friedman said she called USAA.

June 22 Transcript, Page 55, line 20. So, when the car was initally brought to Chilton, at that time it was just for the purpose of getting an estimate for repairs, correct? “ Correct ”. This ignores that the estimate was submitted to USAA and USAA wrote a check to cover the full amount just four days later. USAA forwarded that estimate to Farmers Insurance and that as late as July 7th believed it was the possible liability. He claims he is the primary driver although he drives a 2012 GMC Yukon Denali and she drives the Audi.

While Mr. Friedman claims Multi Craft had worked on another car for them, Greenspan went to great lengths to prevent Plaintiff from obtaining subpoenaed documents that would have shown a history of previous repairs. If there was no history, his client was lying.

June 22 Transcript, Page 56, line 23 “Had that Audi ever been in an accident of any kind? “No”

Although the white paint on the tail light could not come from plaintiff’s black bumper, both defendants signed DMV statements under penalty of perjury when they cited Plaintiff as the responsible other party.

June 22 Transcript, page 61, Line 8 It’s your understanding that Multi Craft came back with an estimate that was slightly higher than Chilton, correct? “Correct” “Their labor rates were slightly higher than Chilton”. Fact: Multi Craft issued an invoice for $1,366.17 when the car was delivered on June 23rd. Neither they nor any other local shop or adjuster was asked for a second quote. The Automotive Repair Act requires all repair shops to prepare a written estimate and do nothing until authorized to make repairs. The estimate dated June 24th, was actually Chilton’s, modified by Brian Downey of Arizona, some 760 miles away. He changed the labor rates and added repairs to the lower spoiler that Chilton said was not damaged. This was done on orders from USAA to fraudulently raise the total cost to Plaintiff. Chilton said it would need three days to make the required repairs but Multi Craft had it only for one full day.

Todd Friedman stated he believed they had been harassed. Consider that Michele Friedman fled the scene of a hit and run providing only a first name and never returned, Todd Friedman left a phone message trying to scam a cash settlement, USAA sent an extortion letter for unspecified damages, the DMV tried to suspend Plaintiff’s license over a delayed SR-1 filing which led to a chargeable accident that caused a 68% increase in premiums. Plaintiff only found out about the SR-1 and affidavit though a Public Records Act request, and only found out about Chilton, Multi Craft and statements made to Farmers through the subpoena processs, that on Halloween 2017, and again in 2018, Michele Friedman showed up at Plaintiff’s house twice with the same child, taking pictures at the sidewalk when the woman handing out candy (the witness) recognized her and wondered if she was being targeted or stalked, then Defense attorney resorted to ambush tactics at trial. When defense couldn’t get $30,000 in legal fees, he filed a false amendment for $1,053 as punishment. Now that’s harassment.

The Defense did not provide any actual facts or evidence to support any of their allegations. Is perjury still a serious offense or should it be allowed in order to win at all cost?

III. CONCLUSION

The Appeals Court should find:

That the transferred white paint did not come from plaintiff’s vehicle and Defendant, Michele Friedman was backing in the wrong direction making her the cause of the accident.

That the Defense attorney, Ryan Greenspan, refused all attempts at discovery, including refusing to meet and confer over the Trial Brief leading to an ambush situation at Trial, then lied multiple times in the Trial Brief to discredit and undermine Plaintiff’s legitimate complaint of insurance fraud and that the false claims suborned the perjury of his clients. After being denied reimbursement of legal fees and expenses, he has filed a false Amended Judgment to recover Defendant fees that were previously denied.

That Defendant, Michele Friedman lied to two insurance companies, the DMV, and under oath at Trial [P.C. 118], and conspired with the repair shop and two rogue employees of USAA to fraudulently inflate the repair costs [P.C. 182].

That Todd Friedman lied in his phone call about a dent in the fender and non-existent estimates [P.C. 118] while trying to scam a cash settlement, then filed a false statement with the DMV claiming Plaintiff caused $1,366 of damage, and lied under oath at Trial.

That the Amended Judgment After Trial, filed August 15, 2018 should be vacated and the case be remanded back to Trial Court for retrial

That Defendants should be referred to the San Mateo County District Attorney to file charges under P.C. 872. for one count of Insurance Fraud [P.C. 550], one count of conspiracy [P.C. 182] and up to four counts of Perjury [P.C. 118]

IV RELEVANT STATUTES

VEHICLE CODE

V.C 20002, Misdemeanor Hit and Run

(c) Any person failing to comply with all the requirements of this

section is guilty of a misdemeanor The driver shall immediately do either of the following:

Present his or her driver’s license, and vehicle registration, to the other driver,

The information presented shall include the current residence address of the driver and of the registered owner. He or she shall also, upon request, present his or her driver’s license information. Michele Friedman left the scene giving only her first name and never returned.

CRIMINAL CODE

P C 550 Insurance Fraud

(a) It is unlawful to do any of the following, or to aid, abet, solicit, or conspire with any person to do any of the following:

(1) Knowingly present or cause to be presented any false or fraudulent claim for the payment of a loss or injury, including payment of a loss or injury under a contract of insurance. The Friedmans filed a false claim for payment of a loss to Farmer’s Insurance Exchange.When the claim or amount at issue exceeds nine hundred fifty dollars ($950), the offense is a felony.

P C 118. Perjury

(a) Every person who, having taken an oath that he or she will testify, declare, depose, or certify truly before any competent tribunal, officer, or person, in any of the cases in which the oath may by law of the State of California be administered, willfully and contrary to the oath, states as true any material matter which he or she knows to be false, and every person who testifies, declares, deposes, or certifies under penalty of perjury in any of the cases in which the testimony, declarations, depositions, or certification is permitted by law of the State of California under penalty of perjury and willfully states as true any material matter which he or she knows to be false, is guilty of perjury. Both Friedmans signed statements to the Dept of Motor Vehicles under penalty of Perjury

P C 182 Conspiracy.

(a) If two or more persons conspire:

(1) To commit any crime.

The Friedmans, Multi Craft Auto Repair, Christopher Baca and Bryan Downey conspired to fraudulently increase the Friedman’s repair cost from $963.17 to $1,366.17.and collect a settlement from Farmer’s Insurance Exchange.

CALIF CODE OF REGULATIONS

CCR 2695.85 Automotive Repair Act.

This act requires every repair shop to prepare a written estimate and provide it to the customer before beginning any work. The customer must give an affirmative authorization in advance. Only after all work is completed may a shop prepare an invoice. Multi Craft was told by USAA to write the invoice and never prepared their own estimate. The invoice was dated one day before Downey’s estimate.

INSURANCE CODE

I C 758.5. (a) No insurer shall require that an automobile be repaired at a specific automotive repair dealer, as defined in Section 9880.1 of the Business and Professions Code. USAA told the Friedmans not to go to Chilton’s Body Shop (.3 miles) but go to Multi Craft Body Shop (1.5 miles) and pay them the exact same amount they were paid for Chilton’s..

I C 1668 License Qualifications

(n) The applicant has aided or abetted any person in an act or omission which would constitute grounds for the suspension, revocation or refusal of a license or certificate issued under this code to the person aided or abetted;

(o) The applicant (USAA) has permitted any person in his employ to violate any provision of this code. USAA employs Christopher Baca and Bryan Downey who conspired to fraudulently increase the Friedman’s repair cost. The attorney for USAA alleged that Downey was an employee of USAA and therefor could legally alter Chilton’s estimate. His employment status has not been confirmed.

I.C. 1871.7 (b) Every person who violates any provision of this section or Section 549, 550 , or 551 of the Penal Code shall be subject, in addition to any other penalties that may be prescribed by law, to a civil penalty of not less than five thousand dollars ($5,000) nor more than ten thousand dollars ($10,000), plus an assessment of not more than three times the amount of each claim for compensation, as defined in Section 3207 of the Labor Code or pursuant to a contract of insurance.

I C 14020. No person shall engage in a business regulated by this chapter, or act or assume to act as, or represent himself or herself to be, a licensee unless he or she is licensed under this chapter.

No person shall falsely represent that he or she is employed by a licensee.

I C 14045. A licensee shall not advertise or conduct business from any location other than that shown on the records of the commissioner as his or her principal place of business. Bryan Downey is 760 miles from the car location.

I C 14064. The commissioner may suspend or revoke a license issued under this chapter or may issue a restricted license in accordance with Section 14026.5 if the commissioner determines that the licensee, or his or her manager, if an individual, or if the licensee is a person other than an individual, that any of its officers, directors, partners, or its manager, has committed any act in the course of the licensee’s business constituting dishonesty or fraud. Downey used Chilton’s estimate without their knowledge or permission and made undocumented changes.

Although Downey’s actions may have been allowed as an employee of USAA, the intent was clearly to circumvent California law.

V CERTIFICATE OF COMPLIANCE

Pursuant to Rule 8.204(c) of the California Rules of the Court, I hereby certify that this brief contains 6,405 words, including footnotes. In making this certification, I have relied on the word count of the computer program used to prepare the brief.

Date: November 14 , 2018

S/ _________

Michael P. Mellema

APPENDIX

Amended Judgment Cover Letter and Analysis

Google Satellite Street Map

Exhibit 1 Defendant’s Damage Claim Photographs

Exhibit 2 Chilton’s Repair Estimate and Deposition

Exhibit 3 DMV SR-1 and USAA Demand Letter

Exhibit 4 Plaintiff’s Vehicle Photographs

Exhibit 5 Defendant’s Statements to Farmers Insurance and Graphic Analysis

Exhibit 6 Payment History – USAA Check to Defendant

Exhibit 7 Multi Craft Invoice and Deposition

Exhibit 8 Downey’s revised Chilton Estimate

Exhibit 9 Defendant’s Phone Call Transcription

Exhibit 10 Payment History – Defendant and USAA to Multi Craft

Witness Notarized Statement